Footnotes

- According to Anderson Economic Group

- S&P Estimates

- Deal Count / Volume represents both announced and completed transactions

- Transaction Value include deals with terms disclosed

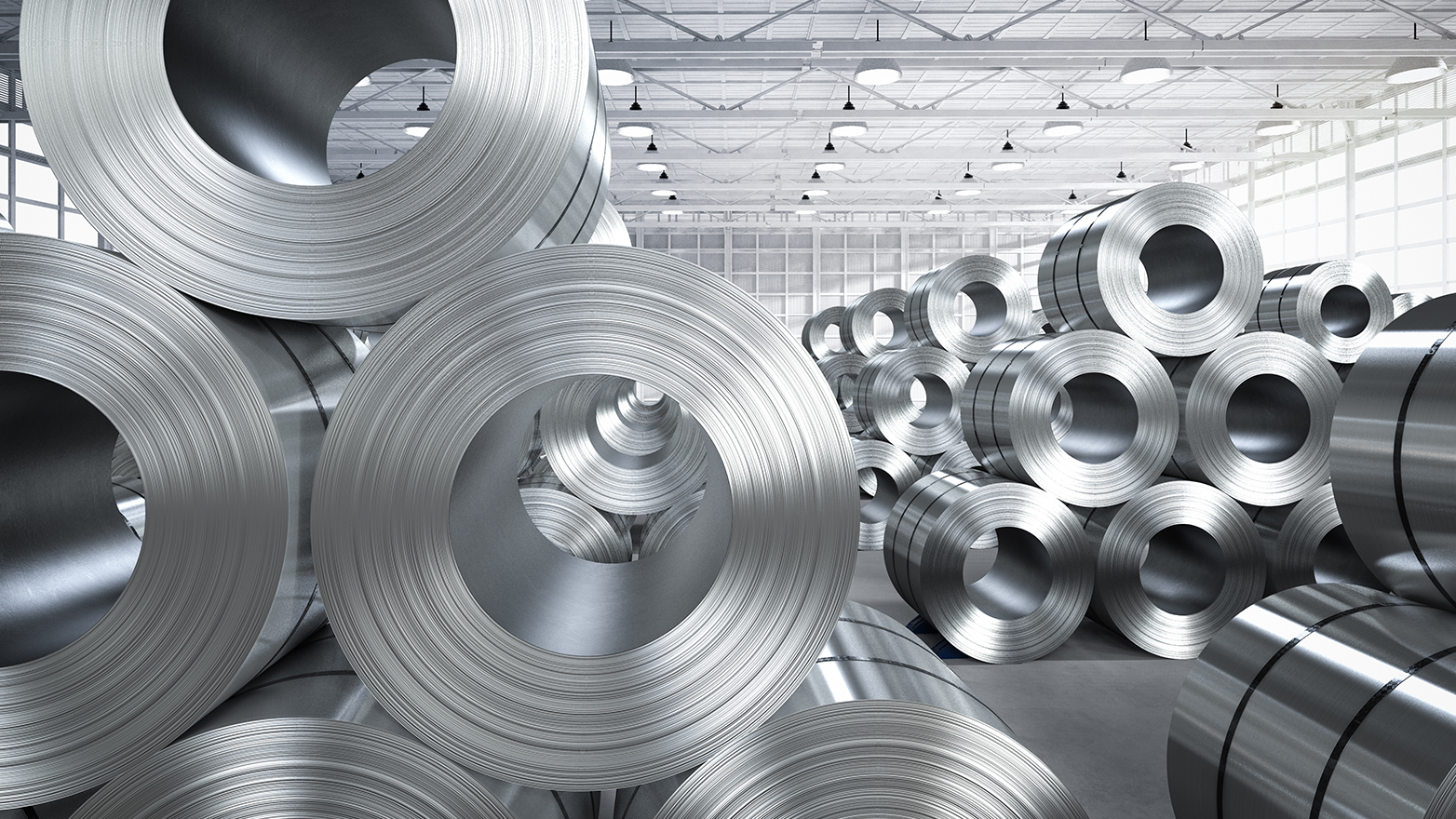

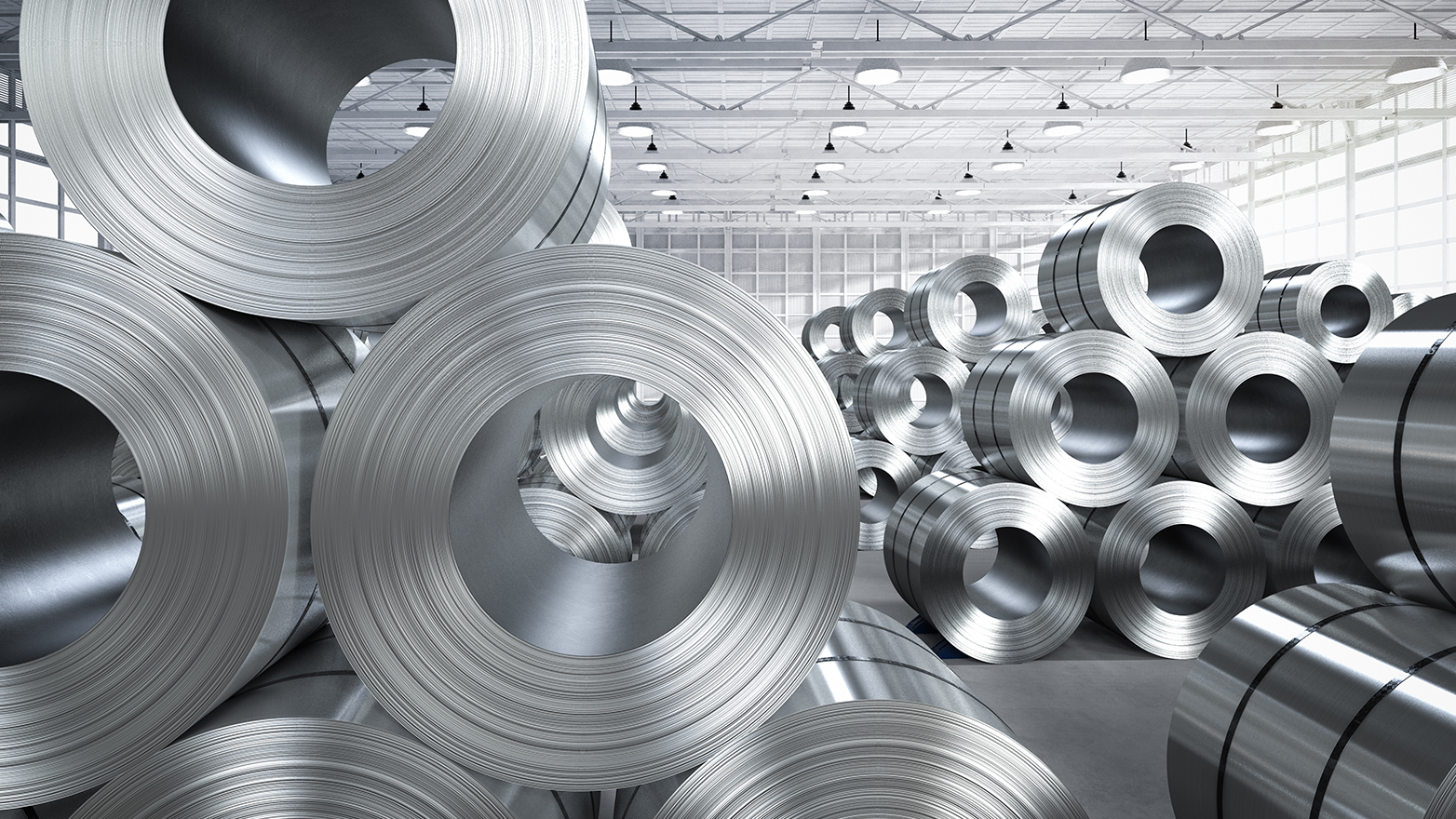

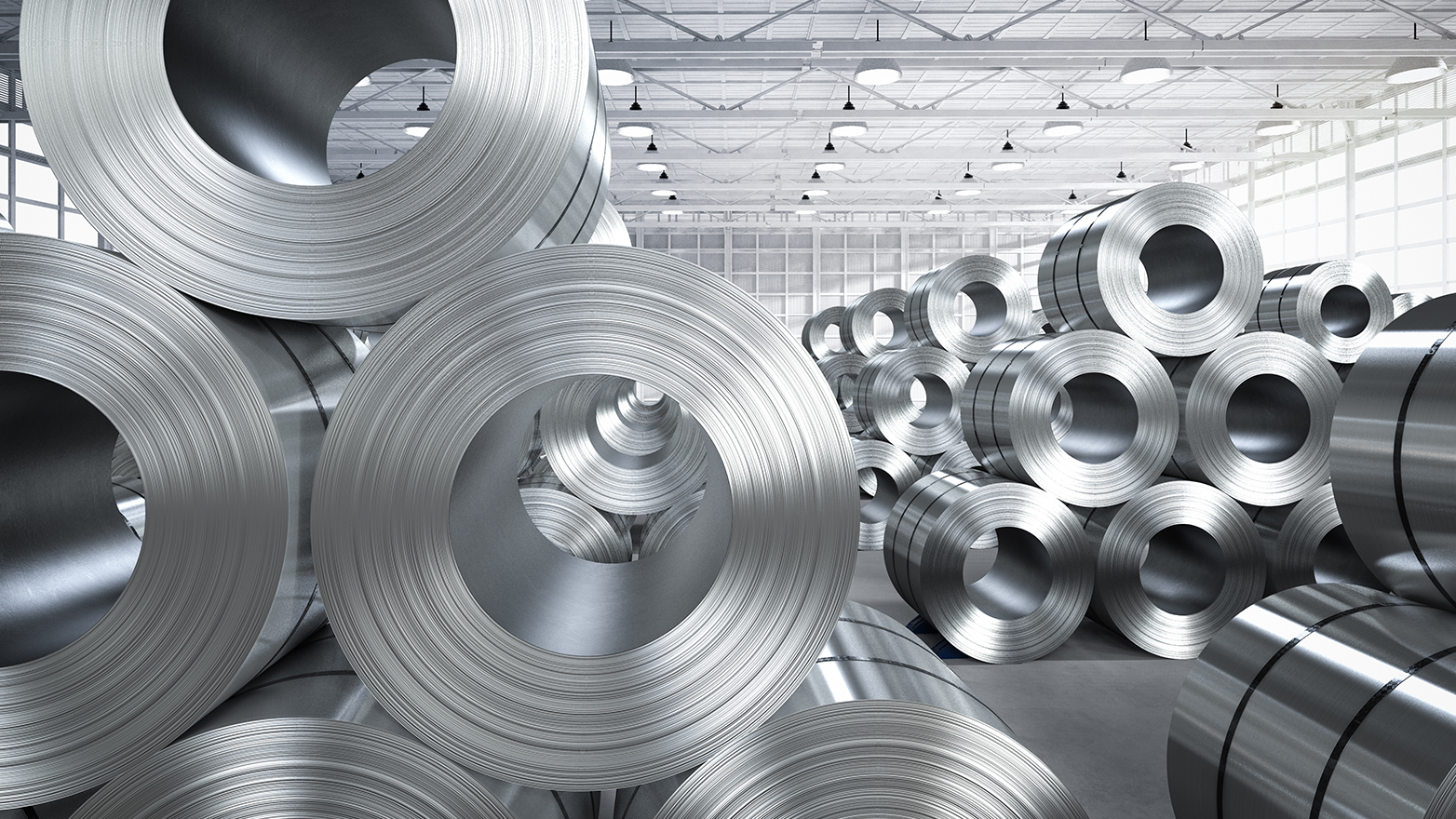

Metals Market Commentary

Amid the current environment of decreasing metal prices and fluctuating demand, a cautious optimism remains in the U.S. market due to the significant tailwinds expected within the infrastructure, automotive, and energy sectors in the mid to long term. Although the recovery in China, both the largest producer and consumer of steel, remains uncertain, the country’s key manufacturing indicators are certainly encouraging, suggesting its economic stabilization measures, including interest rate reductions and consumer credit-friendly initiatives are proving effective.

In the U.S., implementation of federal legislation such as the Bipartisan Infrastructure Bill, Inflation Reduction Act (IRA), and CHIPS and Science Act are expected to further bolster metals demand, given the scale of planned investments and incentives aimed at encouraging reshoring, strengthening the domestic supply chain, and revitalizing aging infrastructure.

Additionally, the growing emphasis on decarbonization is fueling green steel demand, as energy storage installation and new facility construction are metal-intensive activities.

While the overall outlook remains positive, the combination of high interest rates and tighter credit is weighing on demand. Further, elevated input costs such as labor and energy coupled with declining metal prices are contributing to a decrease in producers' earnings.

Within automotive, a sector expected to contribute significantly to the growth trajectory in metals, the United Auto Workers (UAW) is on strike at select Big Three auto plants, costing the large OEMs collectively an estimated $1.12 billion(1) in just two weeks. The strike which began in mid-September is giving rise to production cuts which translate to reduced daily steel usage of approximately 6,000 tons(2). In addition, spot prices for benchmark coiled sheet steel, commonly used to make automotive parts, have fallen 40% since April.

We hope you find this information valuable, and as always, feel free to reach out if you would like to discuss in further detail. To read the full report, download the PDF below.

Metals Newsletter Q3 2023

Download PDF

Industrial markets

KPMG Corporate Finance LLC’s investment bankers have extensive Industrial Markets transaction and industry experience, which enables them to understand the industry- specific issues and challenges facing our clients.

Metals Newsletter Q1 2023

M&A activity and industry trends

Metals Newsletter Q2 2023

M&A activity and industry trends

Metals Newsletter Q4 2023

Read more about M&A activity and trends in the sector

In today’s market, you need an advisor with objective insight at every step of the transaction process. We work with you throughout the full deal cycle to create value and successfully execute your deal strategy.